Money doesn’t grow on trees but for many teens and young adults, the real worry is whether their parents can see every swipe of their credit card. Since purchases leave a clear trail through statements, mobile apps, and transaction alerts, account owners often have full visibility. The truth is simple: yes, parents can track spending if they own or manage the account, but no, they can’t automatically do so if you’re 18+ with your own independent card. With studies showing that 31% of parents reported kids making unauthorized purchases averaging $170 per incident, it’s clear why understanding credit card statements, joint accounts, and privacy rules is essential to balancing financial independence and responsibility.

Understanding How Credit Card Purchases Show Up

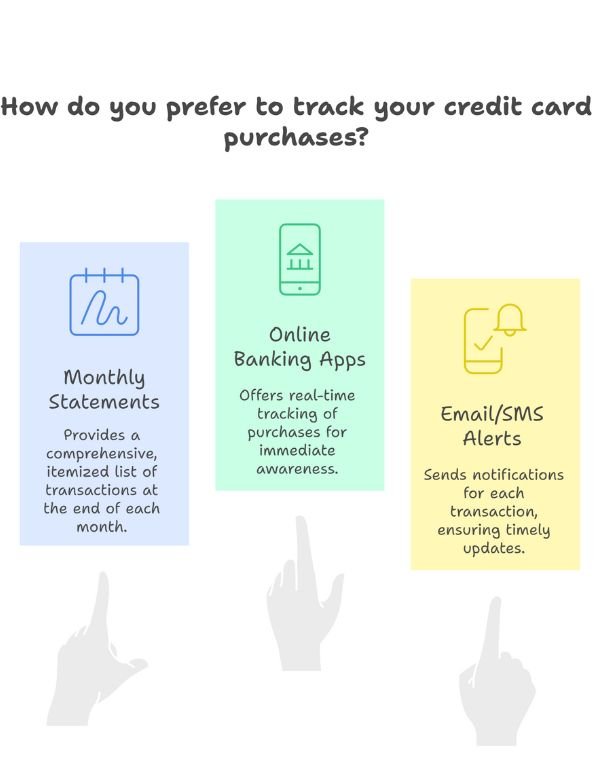

Every time you swipe a credit card, the transaction creates a record that can look different in multiple instances. How much your parents can see of what you buy typically depends on the manner in which they view these records. Here’s how reasonable purchases are likely to look:

Monthly statements: an itemized list of transactions

Credit card companies provide an itemized statement every month, either through the mail or electronically. These statements give the purchase date, store name, a Although statements seldom include a full list of the items you purchased, they do reveal where and when you spent money. If your parents are the recipients of these statements, they will get a complete summary of everything you spend for that billing cycle.

Online banking apps: real-time purchase tracking

Today most banks and credit card issuers have some form of mobile app and an online dashboard. The tools allow cardholders to monitor purchases in real time, even within seconds of swiping. If your parents are the account holders, they can log in at any time and see not only what charges you’ve made recently but also upcoming ones. This makes it nearly impossible to “hide” purchases on an account that belongs to a parent.

Email or SMS alerts: notifications for each transaction

Most credit card accounts allow users to establish automatic alert emails that activate each time a purchase is made. These can be sent as a text or email and typically include the name of the merchant, store location and amount paid. When you buy a $15 movie ticket, for instance, your parent may get an immediate text: “$15 charge at AMC Theatres.” Why this address won’t work for you: If your parents get alerts, they will know about the purchases as soon as you make them.

3. Factors That Decide If Parents Can See Your Purchases

Whether parents can see your credit card activity largely depends on who owns the account, what kind of card you are using and how statements are accessed.

Who Owns the Credit Card Account?

If you are a cardholder and the cardholder is just “your parents,” then they can see every transaction that occurs on the account since the account is in their name. So if the card is in your name, and you’re 18 or older, your parents don’t automatically have access to see what you’ve been buying.

Type of Card You’re Using

The type of account matters. With joint accounts, both you and the other party can see all spending, while authorized user accounts allow parents full visibility but they’re not yours. Debit cards also function differently from credit cards in that charges are drawn directly out of a bank account, which parents can often track.

Access to Online Banking or Statements

Parents with a login to online banking or email-based alerts learn of every purchase immediately, even if you do have some independence. If the statements are mailed to the family home, they will also have a transparent monthly breakdown of where (and how) the money was spent. Preparing your Kids for the Digital Economy means helping them understand how digital payments, banking apps, and financial alerts work.

Legal and Privacy Aspects

The law also sets standards, beyond who owns the account, as to who can see your credit card activity. Whether parents have a legal right to see your spending depends on age, consent and financial privacy protections. The legal and privacy aspects are the following:

Can Banks Legally Share Your Information?

Banks aren’t allowed to pass your financial information around. They are subject to stringent privacy laws that safeguard customer information. But if your parents are the account holders, they have a legal right to know about all transactions, since the account is theirs.

Age and Consent Factors

If you are younger than 18, in most cases you will not be able to open a credit card under your name solely. Instead, you’ll have to recruit a parent or guardian to co-sign and in effect tether the account directly to them. You can get this around the time you turn 18 for your own card, which may give you some privacy and let you start driving on your financial history.

Financial Privacy Laws

In the U.S., legislation such as the Fair Credit Reporting Act (FCRA) help safeguard your personal financial information from being shared. These statutes specifically exclude adults from account activity disclosure without their permission. But until you come of age and actually have an account yourself, your parents can see everything you do.

Situations Where Parents Can See Purchases

Parents usually have access to your spending when they are connected to the account in some way.

- They pay the bill: If your parents are responsible for covering the monthly balance, they’ll receive the full statement and see every transaction made.

- They receive statements: Paper or digital statements outline each purchase with the merchant name, date, and amount, giving them a clear record of your spending.

- You are an authorized user: As an authorized user on their account, every purchase you make shows up on their billing history, giving them full visibility.

Situations Where Parents Can’t See Purchases

There are also cases where your parents won’t automatically know what you’re buying.

- You have your own independent credit card account: Once you’re 18 and open a card in your name, only you control the statements and transaction history.

- They don’t have access to your online banking or email alerts: Without login details or linked notifications, parents can’t track your purchases in real time.

- You manage delivery of statements: If you opt for paperless billing and ensure statements are sent only to your email or app, your parents won’t see them unless you share access.

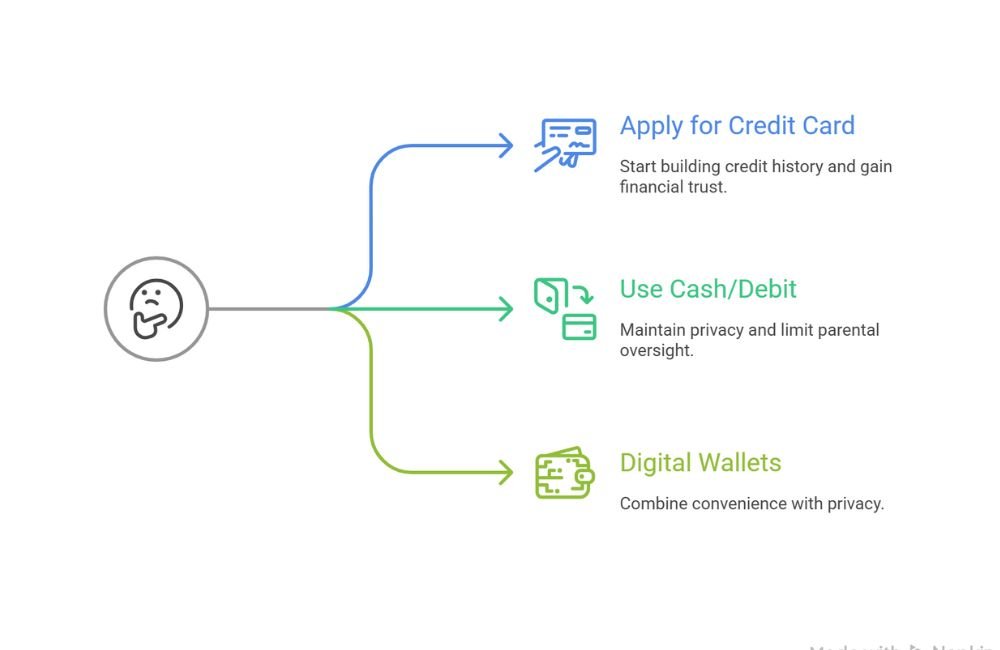

How to Request Your Own Credit Card

You can apply for a student credit card or secured credit card as soon as you’re 18. These are tailored to beginners, allowing you to start establishing a credit history while also letting you have full control over statements and account access.

Importance of Responsible Credit Use

Independence comes with responsibility. Paying on time, keeping spending in check and avoiding debt will mean by the time you are winding your way around campus with bags full of guidebooks and fluffy towels, you’ll already have a positive credit score as well as some financial trust from both banks and parents.

Alternatives for Private Purchases

If you’re not ready for your own credit card, opt for cash, preloaded debit cards or digital wallets such as Apple Pay and Google Pay. These options are more private and limit what parents can see.

Maintaining Trust While Respecting Independence

Yes, privacy matters but so does trust. If you’ve talked openly with your parents about why you want to be financially independent, that can help you set healthy boundaries and show that you’re responsible when it comes to money.

FAQs

They will see “Amazon” and the amount charged, but won’t see what specific items you bought.

Statements may typically display only the merchant name and total amount, but not itemized line details.

No unless the account is in your name only, you are the only one who can see these transactions.

Yes, you can ask to have it with drawn but your (most likely) Parent account holder has to approve.

Both show the merchant, date and amount, but a debit comes out of your bank account.

Conclusion

If your parents own or manage the account, they can see your balance and most recent transactions. They can also see how much you’ve paid on this bill cycle from the “view” menu. However, they cannot see long term balances or transaction history if you’re 18 years old with a separate card of your own name. Creating financial independence is about using credit responsibly, paying on time and being open with your parents.” If you’re ready to say enough and take control of your spending, one way to safely build credit on your own terms is by getting a student or secured credit card.